The liquid assets for trading in Currency Derivatives

contracts are to be maintained separately in the Currency Derivatives

Segment.

The types of liquid assets acceptable by ICCL from the clearing members and the applicable haircuts and concentration limits are listed below:

| Cash Component: Cash & Cash Equivalent |

| Eligible Collateral |

Hair-cut |

Remarks |

| Cash |

No haircut |

- Single Bank Exposure Limits

- Overall Bank Exposure through Clearing Member Collateral

|

| Bank Guarantees (“BGs”) |

No haircut |

- Single Bank Exposure Limits

- Overall Bank Exposure through Clearing Member Collateral

|

| Bank Fixed Deposit Receipts (“FDRs”) |

No haircut |

- Single Bank Exposure Limits

- Overall Bank Exposure through Clearing Member Collateral

|

| Securities of the Central Government (T-bills and G�Secs) |

2% / 5% / 10% |

No limit |

| Units of growth plans of overnight mutual fund schemes |

5% |

No Limit |

| Units of overnight mutual fund schemes (other than growth plans), liquid mutual fund schemes or government securities mutual fund schemes (by whatever name called which invest in government securities) |

10% |

No Limit |

| Non- Cash Equivalent |

| Eligible Collateral |

Hair-cut |

Remark |

| Equity shares with impact cost of upto 0.1% for an order value of Rupees 1 lakh and traded for at least 99%of days over the period of previous 6 months. |

VaR Margin based on 6σ, subject to minimum of 9%. |

Single Issuer Limits |

| Units of mutual fund schemes other than those listed under cash equivalents. |

VaR Margin based on 6σ, subject to minimum of 9%. |

No limit |

| Corporate Bonds |

Fixed percentage based or VaR based haircut. A higher haircut may be considered to cover the expected time frame for liquidation. However, the haircut shall not be less than 10%. |

Single Issuer Limits |

* Prudential Limit shall be applicable as per the guidelines prescribed in the SEBI Circular "Norms for acceptable collaterals and exposure of Clearing Corporations" SEBI/HO/MRD/MRD-PoD-3/P/CIR/2024/65 dated May 29 , 2024

List of eligible securities and mutual fund units

- The cash/cash equivalent component should be at least 50% of the total liquid assets.

- Hence, non-cash equivalent component in excess of the total cash/cash equivalent component would not be considered as part of Total Liquid Assets.

- Further, the Liquid Assets deposited in form of cash equivalent and non-cash equivalent are subject to the norms in respect of applicable haircuts, single bank and single issuer exposure limits, etc. as per the guidelines issued by Securities and Exchange Board of India (SEBI), as well as any other circulars/guidelines that may be issued in respect of the same by BSE/ICCL from time to time.

- The Clearing Member shall meet with the minimum liquid assets requirements prescribed by ICCL at all points of time.

- The Clearing Member's liquid net worth after adjusting all the margin requirements must be at least Rs. 50 Lakhs at all points in time.

- Accordingly, every Clearing Member would be required to maintain Minimum Liquid Net worth of Rs. 50 lakhs with ICCL. At least Rs. 25 lakhs of MLN should be in form of cash/Cash equivalent and the balance in form of Cash/Cash equivalent/non-cash equivalent.

Clearing members may deposit additional liquid assets at any point of time based on the composition of Liquid Assets as detailed in above.

Cash Deposits:

- For enhancement of cash collateral towards liquid assets, the Clearing Members need to send their online instruction in respect of same through the on-line web-based facility CLASS Module to their respective Clearing Banks for confirmation of such request for enhancement of cash collateral.

- Alternatively, in case of any contingency the Clearing Members and their designated Clearing Banks may at their discretion avail the facility of manual updations of cash collateral. For this purpose, the members may instruct their Clearing Banks to confirm the cash collateral deposits to the ICCL through written mode viz. Fax, letters or email. Based on such written confirmations received from the Clearing Banks, the cash collateral deposits of the members will be manually updated in the system by the ICCL.

Bank Fixed Deposit Receipts (FDRs)

- ICCL shall accept the instrument along with the letters if the same are in order and provide the benefit in respect of same to the concerned Clearing Member after confirming the details of the said instrument with the issuing bank.

- Renewal of FDRs: Clearing Members may renew the FDRs deposited towards Liquid Assets by submitting a renewal letter from the concerned bank along with a covering letter by the Clearing Member in the prescribed format.

The Clearing Members can also deposit new/renew the Fixed Deposit Receipts in electronic form (EFDRs) in favour of ICCL towards their Liquid Assets. The process for issuance/renewal of EFDR is as follows:

- Members who wish to avail of the facility can approach any of the empaneled banks

- Submit required documents and information such as member code, segment for which FDR is to be deposited towards Liquid Assets (Collateral) requirements, Amount, Tenure etc.

- Request the bank to create/renew the FDR and mark lien in favour of ICCL.

- Accordingly banks can issue/renew the FDR, with a lien marked in favour of ICCL and confirm the FDR information electronically to ICCL through the system provided by ICCL.

Bank Guarantee (BGs)

- The BGs issued by Scheduled Commercial Banks may be deposited along with a covering letter of the Clearing Member in the prescribed format. ICCL shall accept the instrument along with the letter/s if the same are in order and provide the benefit in respect of same to the concerned Clearing Member after confirming the details of the said instrument with the issuing bank.

- Clearing Members can deposit bank guarantee(s) with/without the claim period. In such cases i.e., where bank guarantee(s) are submitted without a claim period, the amount of the bank guarantee(s) would be removed from the liquid assets of the member at least seven days before the expiry date of the bank guarantee(s) or such other period as may be specified by ICCL from time to time.

- Renewal of BGs: Clearing Members may renew the BGs deposited towards Liquid Assets by submitting a renewal letter from the concerned bank along with a covering letter by the Clearing Member in the prescribed format given to ICCL.

Bank Guarantee in electronic form

The Clearing Members can also deposit/Renew the Bank Guarantees in electronic form in favour of ICCL towards their Liquid Assets.

For details Members may refer Circular No 20150903-26, dated 03, September 2015.

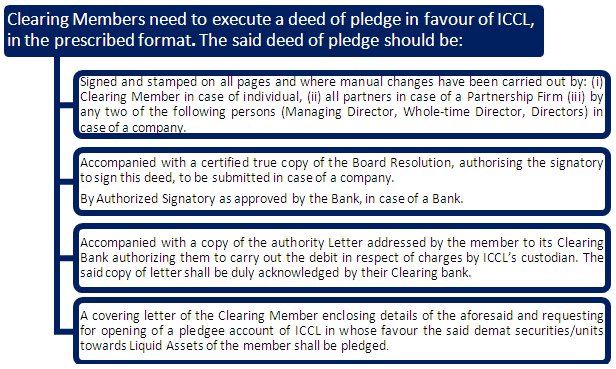

Pledging of demat Securities/MF units towards Liquid Assets:

Clearing Members can initiate pledging of securities/units in favour of ICCL for deposit of same towards their Liquid Assets, and requisite benefits in respect of same shall be provided by ICCL on confirmation of the pledge.

- Clearing Members can deposit eligible securities and MF units in dematerialised form towards liquid assets by way of pledge. The list of eligible securities and units is available on BSE/ICCL web-site. These securities and units shall be pledged in favour of ICCL in the designated depository accounts.

- The valuation of the securities and units deposited towards Liquid Assets shall be in accordance with the norms and limits as prescribed by ICCL from time to time. The value of the securities shall be subject to such haircut as may be prescribed by ICCL from time to time to arrive at the collateral value of the securities. The valuation of securities and units will be done on a periodic interval by ICCL and benefit to the extent of net value of the securities/units after haircut shall be considered. ICCL may revise the list of approved securities/units and the norms in respect of same from time to time.

- Clearing Members shall also ensure that only eligible securities are pledged and lying towards their Liquid Assets with ICCL and that the said securities are not subject to any lock in period, buy back scheme any charge or lien, encumbrance of any kind, or such other limitations or title is questioned before the court or any regulatory body.

Government of India Securities towards Liquid Assets

- Clearing Members may deposit eligible securities in form of Central Government of India Securities (G-Sec) and Treasury bills (T-bills). The list of such eligible securities shall be communicated by ICCL.

- Clearing Members shall ensure that only eligible G-sec and T- Bills are pledged and lying towards their Liquid Assets with ICCL and that the said securities are not subject to any lock in period any charge or lien, encumbrance of any kind, or such other limitations or title is questioned before the court or any regulatory body.

The procedure and list of such eligible securities is available on

Procedure for deposit and withdrawal of Government of India Securities (G-Sec)

Procedure for availing pledging of demat securities/units towards Liquid Assets:

- Clearing Members having active membership status can place their on-line request for release of Liquid Assets lying with ICCL by login through specific user-ids and passwords into CLASS collateral module provided to them.

- Such requests may be considered by ICCL, subject to no lien being exercised by ICCL pursuant to the applicable Rules, Byelaws and Regulations and subject to the availability of the collateral after adjusting for due fulfillment of all obligations and liabilities arising out of or incidental to any deals made by such clearing member/trading member or anything done in pursuance thereof.

- Clearing Members can log in to the web-based CLASS Collateral Module and submit their release requests of collateral/s available collaterals for release.

Transfer of collateral from one trading segment to another trading segment

- Clearing Members can transfer collateral across trading segments, online, to the extent of the amount of collateral lying unutilised towards margins or idle in the trading segment from which it is intended to be transferred.

- Only Fungible BG will be allowed for transfer.

- The evaluation of collateral transfer across the segments will be subject to hair-cut and other criteria/norms in respect of the concerned segments as specified by SEBI/BSE/ICCL in this behalf from time to time.

- Clearing Members may verify the details of their request for transfer and its status in CLASS Collateral Module.